💡 The Core Idea

Inflation punishes rigidity. When we are scared, uncertain, or simply nervous, we clinch. It’s human nature, it’s normal. When you have people in your care span, at scale, we must mature beyond the initial flinch. It’s hard and it’s not for everyone. Leadership is a lonely place.

When prices, tariffs, and input costs rise, organizations that rely on annual budgets, fixed forecasts, and top-down cost control quickly find themselves at a disadvantage. It makes an impact on the bottom line, very quickly (which is sometimes necessary), but long-term, it might be more detrimental.

Let's take a look at the rarity that is flow-based organizations. They don’t just survive, they adapt. They shorten cycles, accelerate learning, and align spending to verified value, not assumptions.

While others tighten, they shorten. It's a different mentality and takes years to learn.

1️⃣ The Reflex to Cut vs. The Discipline to Flow

When volatility hits, most leadership teams reach for the same lever: cut costs.

It’s a reflex, not a strategy.

The logic feels sound. Spend less, preserve margin. But in practice, austerity destroys the very system that generates value.

Each time an organization freezes hiring, pauses investment, or cancels innovation programs, it also severs feedback loops.

The result? Delayed learning, longer cycle times, and hidden work-in-progress that compounds like interest.

A 2023 McKinsey study found that companies that reduced operating expenses more than 15% during downturns recovered three years slower on average than those that focused on throughput and flow efficiency.

💬 Cutting feels safe, but it kills flow, morale, and optionality.

Lean economics is about flow, not frugality.

It’s the discipline to protect the learning system, so decisions improve faster than conditions deteriorate.

2️⃣ Throughput Accounting in Practice

Traditional accounting treats every department as a cost center.

Lean and Throughput Thinking, popularized by Eliyahu Goldratt in The Goal and later refined by Donald Reinertsen, flips that lens.

Instead of asking “Where can we spend less?”, high-performing teams ask:

“Where does each dollar accelerate flow?”

Throughput Accounting measures performance not by cost reduction, but by the rate of value creation within the system's constraints.

Here’s the mental shift:

| Traditional Accounting | Throughput Accounting |

|---|---|

| Optimizes for cost | Optimizes for flow |

| Treats inventory as an asset | Treats inventory as trapped cash |

| Measures efficiency in isolation | Measures system-wide throughput |

| Focuses on headcount | Focuses on constraint performance |

Once you identify your constraint, be it decision latency, a supplier delay, or under-skilled labor, every investment should amplify its throughput, not starve it.

3️⃣ House of Quality Metrics: Connecting Value to Flow

You can’t manage what you can’t trace.

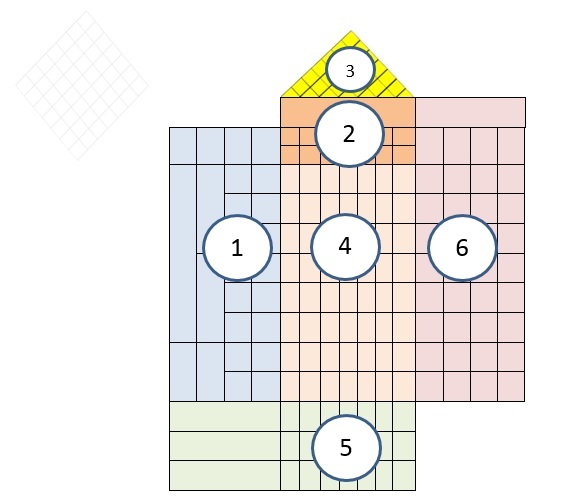

The House of Quality, a core framework within Quality Function Deployment (QFD), bridges customer needs (“the what”) to process capabilities (“the how”).

It provides a structured way to see which design or process attributes actually correlate to customer outcomes.

In practice, it looks like this:

- Columns: Product or process capabilities.

- Rows: Customer or stakeholder needs.

- The Roof: Correlation strength — how each feature, process, or improvement interacts.

When applied to agile or flow-based work, the House of Quality becomes a real-time prioritization engine:

- High correlation = flow accelerator → fund it.

- Weak correlation = waste → cut it.

📊 Example: One global manufacturer used a simplified QFD matrix to trace every project to at least one customer-facing KPI. They found that 27% of active work had no measurable impact on value delivery—and freed up $4M in annual budget by stopping it.

In short: use data to decide what deserves your flow.

4️⃣ Inflation Playbook: Shorten, Don’t Shrink

When inflation surges, most organizations tend to shrink to survive.

However, leaders who understand flow economics tend to shorten instead.

Here’s what that looks like in practice:

| Flow-Based Adjustment | Why It Works |

|---|---|

| Shorter Feedback Loops Replace quarterly reviews with monthly throughput retrospectives. | Increases learning velocity and exposes cost drag early. |

| Smaller Batch Sizes Move from 12-month roadmaps to rolling 90-day investments. | Reduces rework and spreads risk across shorter horizons. |

| Faster Sensing Integrate financial metrics (like cash conversion cycle) into sprint reviews. | Connects real-time operations to financial resilience. |

| Tighter Feedback Use WIP limits to expose real cost drag before it shows up in the P&L. | Eliminates invisible inventory and hidden cycle waste. |

An MIT Sloan analysis showed that a 20% improvement in cycle time correlates to an average 13% gross margin increase, independent of revenue growth.

Resilient companies don’t fight inflation by cutting, they outpace it with shorter learning cycles.

5️⃣ Case Example: Logistics Firm Offsets Tariff Costs Entirely

In 2025, a North American logistics company faced a 15% tariff increase on imported components. Their CFO’s first proposal Headcount reduction.

Instead, the COO ran a complete flow analysis of their distribution process.

Findings:

- 18 days of finished goods sat idle in staging.

- Rework caused by late specification changes accounted for 9% of cycle time.

By reducing batch size, synchronizing supplier flow, and rebalancing WIP limits, the firm released $3.2 million in working capital and reduced lead time by 30%.

That efficiency gain fully offset the tariff impact, without resulting in layoffs or a loss of delivery performance.

Flow, not austerity, became their hedge against volatility.

6️⃣ Metrics That Matter

Most teams still report velocity and utilization.

Those metrics tell you how busy you are, not how resilient you are.

Flow-based economics demands a new dashboard:

| Metric | Definition | Why It Matters |

|---|---|---|

| Cycle Time | Average time from start to finish of value delivery. | The speed of learning and cash realization. |

| Throughput Yield | Percentage of work that results in usable, valuable outcomes. | Measures waste and rework. |

| Cash Conversion Cycle (CCC) | Time between cash out and cash in. | The organization’s financial agility indicator. |

| Correlation Strength (House of Quality Roof) | Degree of link between investment and customer value. | Identifies invisible waste and false efficiency. |

These metrics combine Lean efficiency with financial sensitivity, a smarter resilience index than any cost report.

⚙️ Flow Economics in One Sentence

Resilience isn’t built by cutting what’s visible, it’s built by learning faster than costs rise.

📩 Call to Action

By the end of this week, I’ll share how to transform these flow-based principles into a comprehensive system of Economic Agility, where Finance, Operations, and Strategy utilize rolling feedback loops to navigate uncertainty with confidence.

👉 Follow Big Agile on LinkedIn and subscribe to the Big Agile Newsletterfor that upcoming post.